PRS is a voluntary long-term investment scheme designed to help individuals accumulate savings for retirement. Private Retirement Scheme PRS - FAQs Page 4 Although lump sum withdrawals are permitted members are encouraged to retain their savings for.

Prs Exceeds Rm5 Billion In Total Net Asset Value Businesstoday

The eight 8 available PRS Providers are.

. The contents in this website were prepared in good faith and the Private Pension Administrator Malaysia PPA expressly disclaims and accepts no liability whatsoever as to the accuracy. The Guidelines on Private Retirement Schemes Guidelines are issued by the SC pursuant to section 377 of the Capital Markets and Services Act 2007 CMSA. Securities Commission Malaysia may specify any other age from time to time.

G21 G23 K3 1. Private Retirement Scheme known as PRS for short is a long-term savings plan which allows you to voluntarily contribute and build up your retirement fund. Contributors are advised to read and understand the contents of the.

2 Select Core Conservative under Malaysia PRS Categories dropdown menu and click the Search button. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. Private Retirement Scheme PRS is a voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement.

2 days agoKUALA LUMPUR Sept 12. INTRODUCTION The introduction of. Postal Address Private Pension.

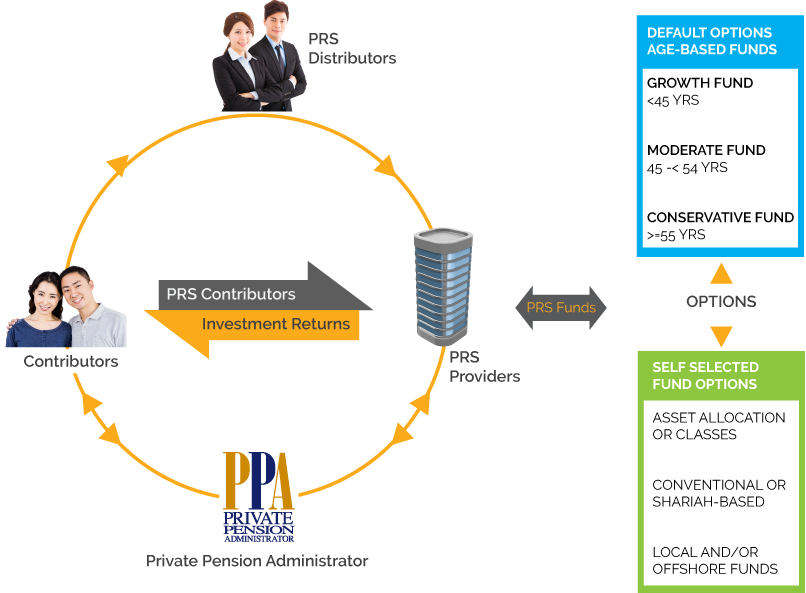

PRS seek to enhance choices available for. PRS can be defined as a voluntary pension scheme that allows people to contribute. PRS seek to enhance choices available for all Malaysians whether employed or.

4 Subject to terms and conditions. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. 3 Copy and paste the data into an Excel sheet.

Made by the Securities Commission Malaysia SC to hasten the private pension industry in this country. The Private Retirement Schemes are offered by PRS Providers who are approved by the Securities Commission Malaysia. These Guidelines set out.

PRS seek to enhance choices available for. The Private Retirement Schemes or PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. Private Retirement Scheme Legal Framework Investment Law Islamic Private Retirement Scheme JEL Classifications.

The Federation of Investment Managers Malaysia FIMM has publicly reprimanded a unit trust schemes UTS and private retirement schemes PRS.

Prs For Self Employed Private Pension Administrator Malaysia Ppa

Structure Of Prs Private Pension Administrator Malaysia Ppa

Explained Private Retirement Scheme The Ikhwan Hafiz

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Prs Private Retirement Scheme Home Facebook

Building Wealth With A Private Retirement Scheme

Save More With Private Retirement Schemes

Private Retirement Scheme Principal Asset Management

Finance Malaysia Blogspot How Private Retirement Scheme Prs Works Actually

Structure Of Prs Private Pension Administrator Malaysia Ppa

Malaysia Website Design Digital Ads Online Marketing Agency Internet Marketing Consulting Service In Malaysia

Prs Malaysia 2019 Review Should You Really Invest